401k Limits 2025 Roth Or Traditional. The roth 401(k) contribution limit is $22,500 in 2025 and $23,000 in 2025. The annual irs contribution limit is $23,000 for 2025 ($30,500 for investors 50 and older).

$ years to invest until retirement plan withdrawals begin: For 2025, the roth 401 (k) contribution limit is $22,500.

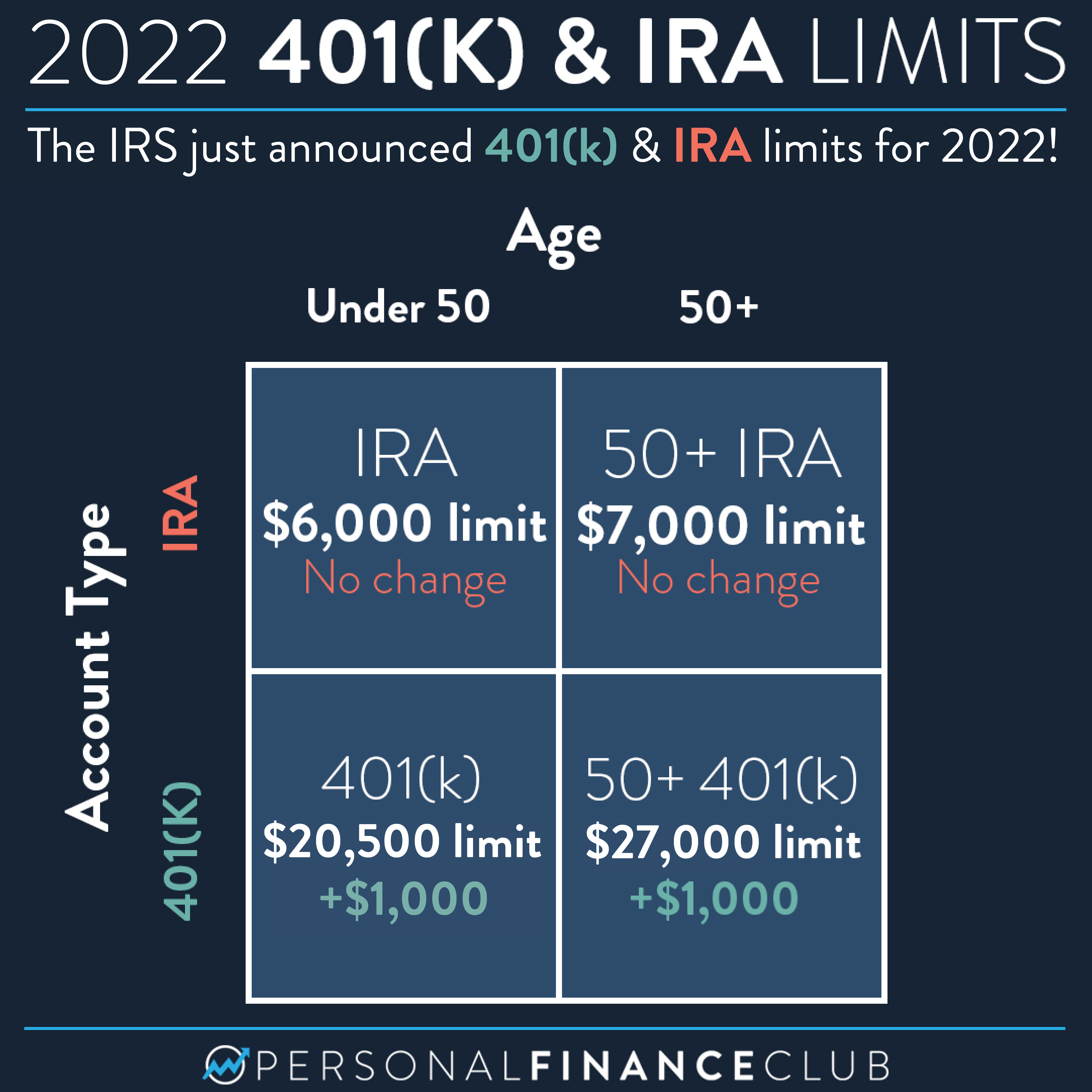

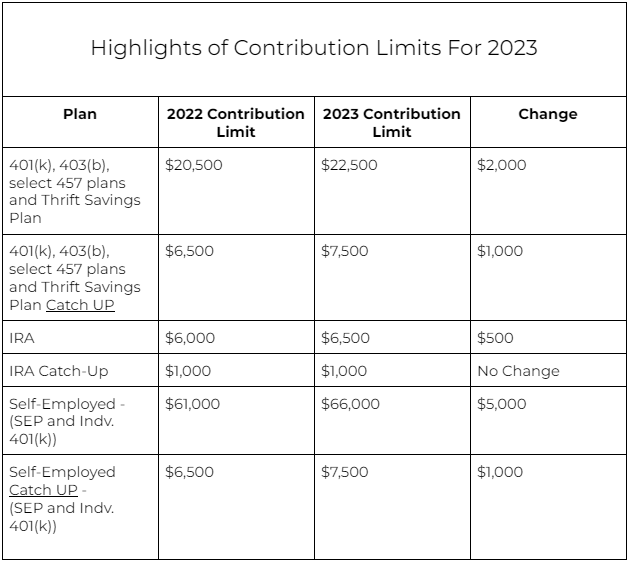

2025 401k Deferral Limits 2025 Sher Koressa, For individual retirement accounts (iras)—both roth and traditional types—the 2025 contribution limit will increase to $7,000, up from $6,500 in 2025.

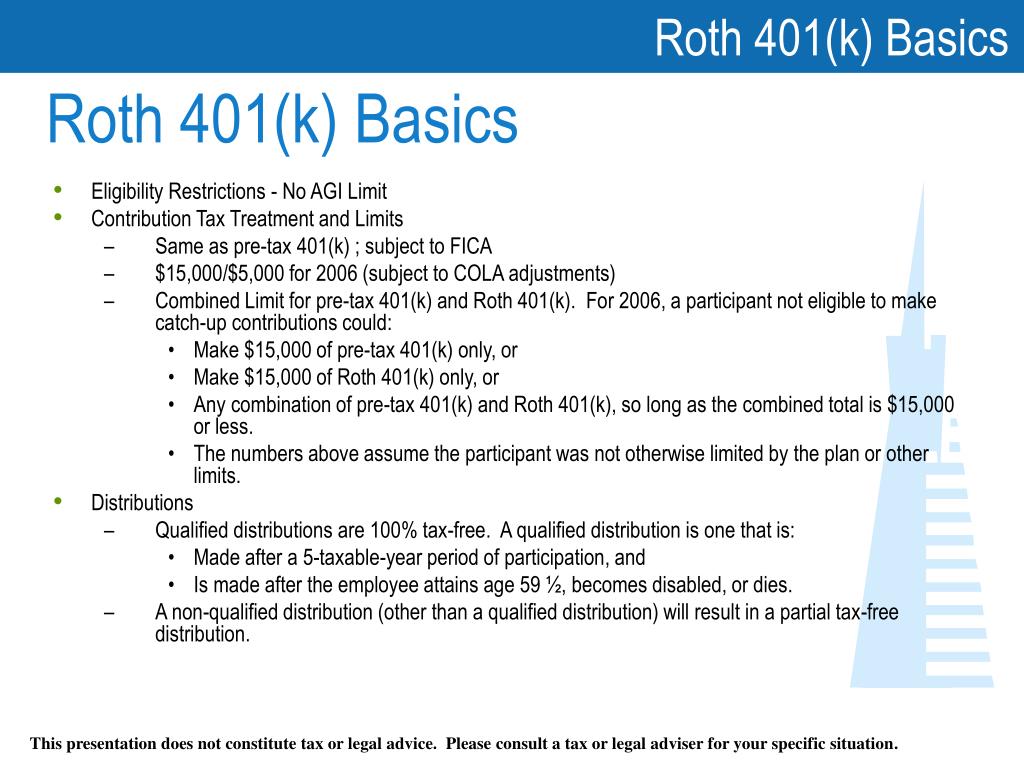

401k Roth Contribution Limits 2025 Over 50 Janeen Terrie, Regular roth ira annual contribution limits apply.

Roth 401k Limits 2025 2025 Korry Maddalena, The annual irs contribution limit is $23,000 for 2025 ($30,500 for investors 50 and older).

401k Limits 2025 Roth Contribution Andy Karlotte, The limit for contributions to traditional and roth iras for 2025 is $7,000, plus an additional $1,000 if the taxpayer is age 50 or older.

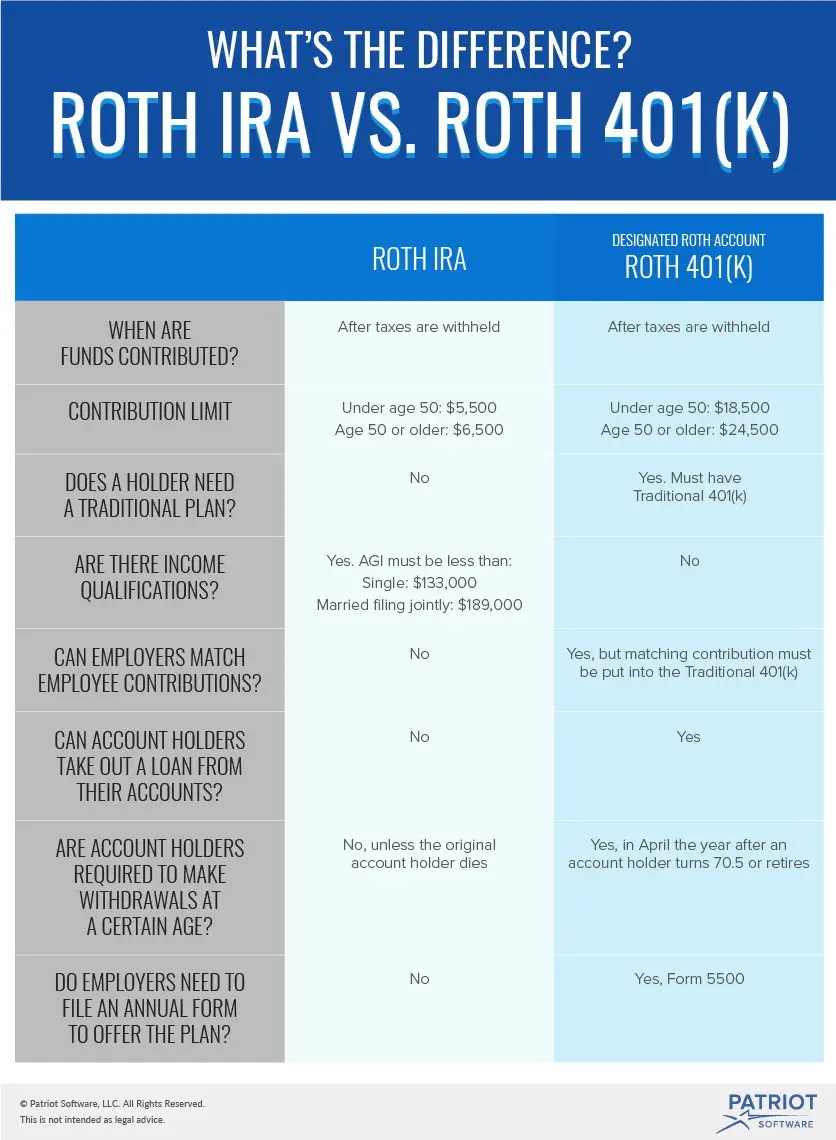

401k Limit 2025 Roth Or Traditional Marge Samaria, The income limits for the roth ira apply only to roth ira contributions, so you could still contribute to a traditional ira up to the $6,500 (or $7,500) limit for 2025, and.

2025 Max Roth 401k Contribution Limits Jess Romola, For 2025, the roth 401 (k) contribution limit is $22,500.

402 G Limit 2025 Catch Up Date Abbie Sharai, For 2025, the roth 401 (k) contribution limit is $22,500.

2025 Roth Ira Contribution Limits 401k Katha Maurene, The income limits for the roth ira apply only to roth ira contributions, so you could still contribute to a traditional ira up to the $6,500 (or $7,500) limit for 2025, and.